In recent weeks, the gaming industry has seen a series of price adjustments from major players. Microsoft initiated the trend by increasing the prices of all its Xbox Series consoles and many of its accessories worldwide, alongside announcing that some new games will cost $80 during the upcoming holiday season. Just prior to this, PlayStation followed suit by raising console prices in select regions, while Nintendo adjusted its Switch 2 accessory prices and introduced its first $80 game. These tariff-induced price hikes have sparked a wave of changes that can be overwhelming for consumers to track.

To understand these shifts, I consulted with industry analysts. The consensus is clear: tariffs are the primary catalyst behind these price increases. Dr. Serkan Toto of Kantan Games, Inc., emphasized that Microsoft's consoles, manufactured in Asia, are directly affected by these tariffs. He noted that the timing of these announcements aligns strategically with the current economic climate, minimizing potential backlash. Joost van Dreunen from NYU Stern echoed this sentiment, explaining that Microsoft's decision to implement global price adjustments simultaneously was a strategic move to consolidate consumer reactions and maintain competitive pricing amidst a service-oriented market trend.

Other factors contributing to the price hikes include rising development and manufacturing costs, as well as macroeconomic conditions such as persistent inflation and supply chain expenses. Piers Harding-Rolls of Ampere Analytics highlighted that the launch prices of competitors like the Switch 2 and Sony's recent adjustments made it easier for Microsoft to act now. He also noted that the price increases were particularly significant in the U.S., largely due to tariff policies.

Will Sony Follow Suit?

The looming question is whether Sony will also raise its prices. Analysts unanimously suggest that Sony is likely to follow suit, especially with hardware, accessories, and games. Rhys Elliott of Alinea Analytics predicts that this is just the beginning, with PlayStation likely to increase software prices as well, given the precedent set by Nintendo and Xbox. Daniel Ahmad from Niko Partners pointed out that while Sony has already raised console prices in regions outside the U.S., the American market might be next due to its significance in console sales.

James McWhirter of Omdia noted that Sony's reliance on Chinese manufacturing exposes it to similar tariff risks as Microsoft. However, the timing around the holiday season could provide some buffer as both companies rely on existing inventories. Mat Piscatella from Circana was more reserved but referenced the Entertainment Software Association's views on tariffs, suggesting that rising prices are a symptom of larger economic pressures.

The Impact on Consumers and the Industry

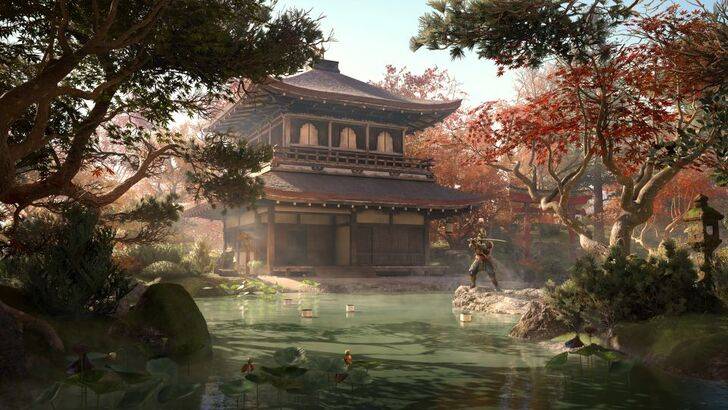

Despite these price increases, analysts do not foresee a significant decline in gaming spending. Microsoft's 'This Is An Xbox' campaign indicates a shift towards a service-oriented platform, potentially mitigating the impact of lower hardware sales. Experts like Harding-Rolls anticipate that while Xbox hardware sales may continue to decline, high-profile releases like GTA 6 could provide a boost in the future.

Elliott emphasized that gaming is price-inelastic, meaning that even in tough economic times, consumers continue to spend on games. This trend is supported by strong sales of PlayStation and Nintendo consoles, despite price increases. Manu Rosier of Newzoo suggested that while total spending may remain stable, consumers might shift their spending towards subscriptions, discounted bundles, and live-service games.

In regions like the U.S., where tariffs are more localized, the impact might be felt more acutely. However, growth is expected in markets such as Asia and the Middle East, according to Ahmad. McWhirter also highlighted that while full game prices have not traditionally followed inflation, the move to $80 games by Xbox and Nintendo suggests a broader trend that other publishers might soon follow.

Piscatella expressed some caution, noting the increased uncertainty in the market. He predicts a potential shift towards free-to-play and existing game ecosystems, as consumers might prioritize spending on necessities over new gaming hardware.

In summary, while the gaming industry faces significant price increases due to tariffs and other economic factors, the overall impact on consumer spending is expected to be limited. The shift towards service-based models and alternative spending patterns may help cushion the blow, but the future remains uncertain as the market navigates these changes.

Latest Downloads

Latest Downloads

Downlaod

Downlaod

Top News

Top News